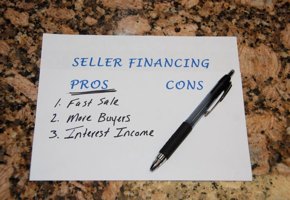

Seller financing or vendor financing is very normal in commercial and multi-family real estate. However, in the residential real estate world—it absolutely blows people’s minds! You want me to what? You did a deal how?

And the next question is ALWAYS, “is that legal?” Yup! 100% With a lawyer for both the seller and the buyer of the home.

And this is usually followed by, “I don’t get it.” Because seller financing is not mainstream, we’ll run through a few examples to explain how it can work.

House A is owned by 2 seniors. Their mortgage is paid off. Their house is lovely—decorated perfectly for the 1980’s! These seniors are down-sizing into a smaller condo which they can finance; however, they don’t have the capital or the energy to manage the renovation that their current house needs. How to sell it in today’s tough market? They can use seller financing where they register a mortgage on the property—AS IF they were a bank. There is an interest rate, a term, and a monthly mortgage payment all specified. There is a time limit to the deal, and penalties are written into the contracts. Now they don’t have to do any work on their house, yet it continues paying them. Lots of seniors would love an extra $1000 to $1500 per month in income! Our renovation company provides peace of mind for these seniors (12 years in business now!), and our investment company manages the home for tenants or Rent to Own clients. The lawyers make sure that Grandpa and Grandma get a fair deal.

House B is owned by a young family. They bought in 2016 for only 5% down. Now they have to move. These smart parents have done their math. If they sell their house today, and pay a realtor’s commission, they have a problem. To clear the mortgage off of title, they have a $5000 penalty. They will have to pay that money out of pocket, just to get out of the house, or risk foreclosure. Using seller financing, we are able to work with them. We pay all the bills related to the house: mortgage, taxes, insurance and maintenance. We do all of the property management. We have a limited time that we will work this deal before finding a Rent to Own buyer for the property. Again, there is a lawyer for the seller, and a lawyer for us. Totally legal in Alberta and it saves the couple from financial disaster. This is usually where people start to say: really?!?

House C is owned by a couple of professionals in mid-life. They have a small mortgage and a lot of equity in this property. Maybe they already have a couple of homes and want to move into the vacation house permanently. Or maybe they have been real estate investors for years, but no longer want the hassles of Property Management. In this case, we have a professional appraiser come in to value the house in today’s market. We sign a Joint Venture agreement that makes this professional couple the “money partner” in the deal. The fun part is, they didn’t do anything to put down any cash or qualify at a bank; this is seller financing at it’s simplest. They still own the house! The Joint Venture agreement allows a “working partner” to come in and take on all the property management. The working partner may receive an annual or monthly fee for managing the tenants or Rent to Own clients, but they don’t benefit until the deal matures (eg the house is eventually sold).

Each story is different. Each story has legal representation for both the seller and the buyer. Are you looking for a creative, but legal, way to sell your house in today’s Calgary market? The contracts can be tailored for many unique situations. And we have access to a fabulous team of experts. One of our lawyers has done more than 25,000 real estate transactions in his career! Connect with us through https://mountainsedgerenovations.com/ or https://mountainsedgedevelopments.com/.

We love finding solutions for real estate problems!