THE RISK OF REGRET

Generally, real estate investors are fabulous at risk analysis! Cash flow, vacancy, future repairs and maintenance, return on investment, return on time, …. You know who you all are!

And please don’t misunderstand: risk analysis is critical to finding and managing solid performing assets.

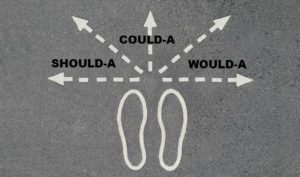

Today, we are only considering the risk of continuing to sit on the sidelines. If you find a cash flowing, under-market-value property in good condition in a good location—what EXACTLY is holding you back?

I can hear the plethora of excuses vaguely disguised as “rationale.” But really it comes down to fear. If an investor finds a deal that ticks all of their boxes, but still doesn’t move forward—then on some level, that investor is afraid of something. And YES your fears are real: What if the pipelines never get built? What if Iran and the USA do go to war? What if rents or real estate prices go down? Any of these things are possible in this crazy world!

But what if oil prices go up as tensions with Iran increase? What if people in Ontario or BC start to realize the bargain prices currently found in Alberta markets? What if global investors look at $500/month cashflow and compare that to the cashflow they can’t find in Toronto? Hmmm. Any of these things is also possible in this crazy world.

When your analytical brain starts pumping fear into your veins, take a breath. If this is a long-term buy and hold property for 5 to 10 years, can you handle a dip in the real estate prices? Well, it’s long term—so you’re not planning to sell this year, right? Now what if you factor in no cashflow, no appreciation, and you JUST have mortgage paydown by your tenants? Okay, so you make $5000 to $10000 this year on your property (based on today’s rents covering your costs). Only you can decide if the “risk” is worth the reward.

No, I am not advocating recklessness or crazy risks. But so many of us get caught up in the HGTV shows that advertise big profits, big appreciations, and glamourous cashflows. I’m asking if less “sexy” real estate investments, that produce slow but steady results, are worth the “risk of regret” in your portfolio. What if 2020 is truly the bottom, and the best prices we might see for another decade or more as #calgaryrealestateinvestors? With all of your other analyses, I’m asking you to consider the risk of staying on the sidelines and perhaps missing the opportunities that abound in Alberta today.

Connect with us anytime to chat about some of the opportunities we are currently working on. https://mountainsedgerenovations.com/ https://mountainsedgedevelopments.com/ @mtnedgerenovate @mtnedgedevelops