CHOICES AND OPPORTUNITIES

Does New Year’s ever feel like this to you? So many targets, goals, and possibilities! Each human has 24 hours a day to spend wisely, how do we decide? Today is the first Friday in January, so it is time for our monthly economic fundamentals update. Maybe perusing the latest stats will help some of us narrow down our next steps? In real estate investing at least!

We always begin with big picture economics: what’s up with GDP (Gross Domestic Product). https://economics.cibccm.com/cds?id=7725052a-d352-4344-8ec7-67610f467855&flag=E This article from CIBC Economic Flash, explains that Canada’s GDP was down 0.2% for the third quarter of 2023 (Q3). August, September and October all showed 0.0% GDP growth. Year over year from Oct 2022 to Oct 2023 showed a modest 0.9% GDP growth. So there’s the national numbers. As for Alberta, ATB is estimating an overall GDP growth of 2.7% that happened in 2023. Then ATB is forecasting real GDP will rise 2.1% for 2024, and 2.7% for 2025: https://www.atb.com/company/insights/the-owl/alberta-economic-outlook-december-202023/. There is also a link in that article for the really big overview of Alberta numbers. What this means to real estate investors is that the national headlines will continue to be a bit gloomy about economic output, but at the moment Alberta is looking strong.

As of today, the most recent job numbers are the next item on our fundamentals list. Canada’s unemployment was unchanged at 5.8%. Alberta’s unemployment was up a bit to 6.3% from 5.9%. Edmonton’s unemployment rate was also up a bit to 6.6% in December from 6.2% in November. Lethbridge also saw a small increase from 4.3% in November, to an unemployment rate of 4.5% in December. In contrast, Calgary’s unemployment was down a bit to 5.9% (December) from 6.1% (November). https://www150.statcan.gc.ca/n1/daily-quotidien/240105/dq240105a-eng.htm. Strong wage growth continues to cause some angst; the latest data showed the national average wage growth at 5.4% (one source also has wage growth at 5.5%). As for actual jobs, national data shows Canada added a net 100 jobs (not a type-O), but Alberta added 6700 jobs in December. Overall, Alberta saw a 3.6% increase in jobs for 2023; this compares to a national job gain of 2.4% (we are the second fastest growing for those who keep scores). Alberta jobs are almost entirely in the private sector (go small businesses, go!), and many are part-time. https://www.atb.com/company/insights/the-owl/labour-force-survey-december-2023/. What this means to real estate investors is that our tenants continue to have access to employment, even as the province grows.

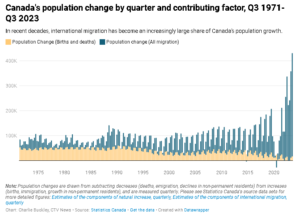

And that brings us directly into our population data. Before anyone gets too excited, the entire country is growing. StatsCan recorded the fastest population growth in Q3 since 1957, with an increase of about 430,000 souls:

Please see the reference at the bottom of the graph.

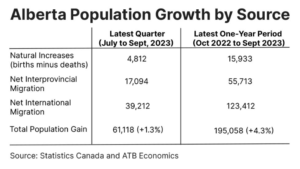

Then we compare the national numbers to Alberta’s population growth. https://www.atb.com/company/insights/the-owl/population-as-of-october-1-2023/.

The bottom right notes that Alberta grew by 4.3% from Q3 2022 through Q3 2023. In the article, ATB references the national population growth rate of 3.2% for the same time frame. According to the Q3 Housing Review, from the City of Calgary, https://www.calgary.ca/research/housing.html, Calgary grew by 5615 people in the third quarter (click on “view latest housing review”). What this means is that Calgary, Alberta and all of Canada have an abundance of buyers and renters for our properties.

To speed things along a bit, we’ll abbreviate the rental market story. The most recent rentals report we’re currently looking at can be found here: https://rentals.ca/blog/november-2023-rentals-ca-report. Rent growth Canada-wide is still high at 9.9%. Calgary saw an overall rent growth of 14.2% for 1 bedroom rentals, and 13.2% for 2 bedroom rentals. Purpose-built rentals in Alberta show an increase rental rate by 16.4%, year over year. For smaller cities/towns, Red Deer purpose-built rentals saw a dramatic rental price increase of 22.3% overall, third in the country?! What this means is that real estate investors are seeing a very strong demand for good places to live.

Calgary’s real estate market continues to be a story of limited supply, with only 1.58 months of supply available. Sales are still impressive, but down from the post-pandemic nuttiness. Trends are moving toward more affordable home styles (townhomes, rowhomes, condo’s). Benchmark price is now $570,100, which is up 10.4% year over year (December 2022 to December 2023). https://www.creb.com/News/CREBNow/2024/January/Strong_migration_and_low_supply_drive_Calgary_housing_prices_in_2023/. Bottom line for real estate investors? If a property can find a qualified buyer, things are moving along nicely for sellers.

There sure are a lot of Green lights for real estate investors these days! Narrowing down our choices will depend on our investing styles and our long term reasons for investing. Those that love cashflow will find their choices narrowed even further, in the current interest rate environment. However, Calgary is soon to release new zoning rules that will become a game-changer! Fingers and toes crossed! This is going to be a very exciting year to invest in Calgary and Alberta real estate. And the best part is that it’s not too hot—we have time to play carefully, and double-check our targets and our choices.