LONG TERM: VISION OR DELUSION?

“The sky is falling!” “The sky is falling!”

Anyone else remember the old story of Henny Penny, or Chicken Little? Same story, but the main character seems to go by two different names, depending on who the storyteller is. But did you know that versions of this story can be traced back 25 centuries?! https://en.wikipedia.org/wiki/Henny_Penny.

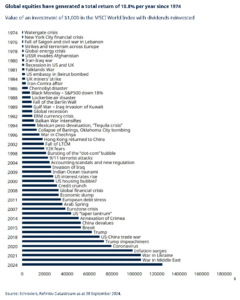

The adult version of this story is the “reasons not to invest” by year. We first heard about it in a REIN room (Real Estate Investment Network). There are a bunch of versions online, but here’s one: https://www.schroders.com/en-us/us/wealth-management/insights/50-reasons-not-to-invest-and-why-you-should-have/. Skip to the end of the article to check out the visual.

This month (or this year so far) has been a little: insert your favorite descriptor: extraordinary, unprecedented, uncertain, confusing, …. “Liberation Day” was followed by markets panicking, was followed by a 90-day exemption for many countries, is currently being followed by some ups and downs, …. All of this is emanating from one disruptor in the global economy!

I think many people can be forgiven for cocooning a little like we did back in the Covid days. As we watch both business https://www.cfib-fcei.ca/en/research-economic-analysis/business-barometer and consumer confidence https://www.conferenceboard.ca/insights/consumer-confidence-plunges-to-historic-low/ bottom out, many people are entering a self-protection mindset. Can you believe that we are now more doom-and-gloom than back in 2020? It hardly seems possible! Until we notice the layoffs in the auto industry (and that’s just one example).

How can we keep calm and act with courage in the face of … haha … anyone have any guesses about what’s coming next?

We are thinking long-term. And we were lucky to be in a room of incredibly intelligent people last night who are also a little discombobulated, but still looking and planning ahead. Thanks to Natasha Phipps and https://wealthshare.ca/ for the incredible networking/education opportunity! Please check them out if you’re interested in a REIT for your savings/portfolio.

In addition to long-term strategies (to avoid short-term panicking), the other theme in the room was about wealth preservation. Whether you have $5,000 in savings or $5,000,000 in a retirement nest egg, everyone wants to keep their capital (at a bare minimum), and ideally figure out a way to keep up with inflation. Growth beyond that is the extra we all strive for!

Preserving wealth doesn’t mean freezing in place and squirreling away pennies (that actually decreases your nest egg—a discussion for another day). The smart real estate investors in the room were all talking about low risk. For example, as sexy as 95% loan-to-value is with a CMHC loan, many investors were favoring other choices that would allow for 65%-75% loan-to-value on a project. Also, real estate investors are well known for their love of investing in something that is backed by a hard asset (see it, touch it, kick it if you must!). For decades, the wealthiest of investors have favored hard assets like gold and real estate during recessionary times. There is no need to re-invent the wheel here; just follow what smart money has done during previous tumultuous years/seasons.

We don’t believe that it is delusional to think that “this too shall pass.” So then, the question becomes how do we move forward, cautiously and with some optimism? We are still strong believers in real estate investments! And we are hopefully envisioning a future with a stronger, better Canada!